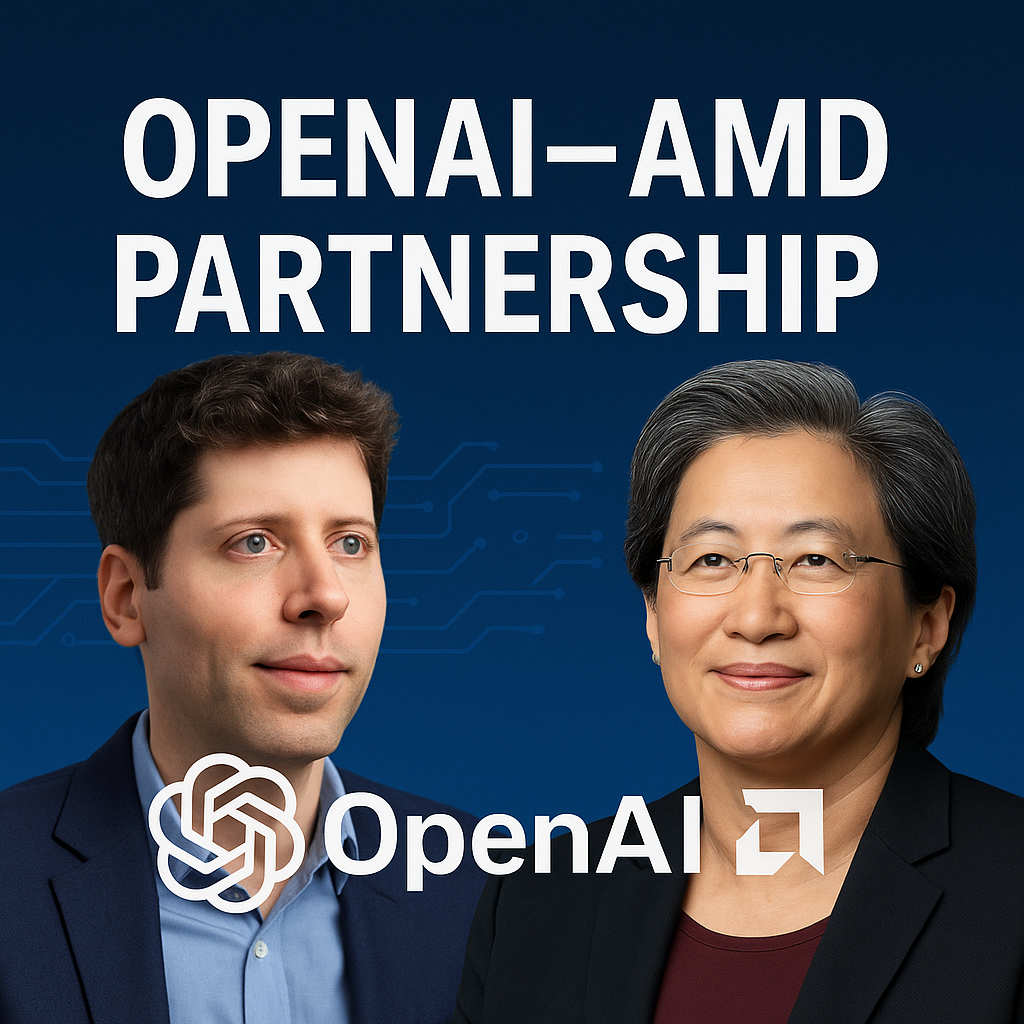

OpenAI and AMD have struck a multi-year partnership centered on deploying up to 6 gigawatts (GW) of AI compute built on successive generations of AMD Instinct accelerators. The agreement kicks off with an initial 1 GW tranche targeted for production in the second half of 2026, signaling a long-term plan to expand capacity as models and workloads scale. Beyond raw hardware, the deal includes a performance-tied equity warrant structure, aligning incentives around timely delivery and execution at unprecedented scale.

Key Takeaways (At a Glance)

Scope: Up to 6 GW of AI compute over multiple years and chip generations.

Kickoff phase: ~1 GW using AMD Instinct MI450 series, planned to begin 2H 2026.

Incentives: Equity warrants tied to milestones and delivery performance.

Strategic goal: Diversify OpenAI’s supply beyond a single vendor and ease compute scarcity.

Market impact: Positions AMD as a credible large-scale alternative for training and inference.

What Exactly Was Announced?

The partnership commits OpenAI to a multi-year roadmap with AMD, starting with a 1-GW buildout and expanding toward 6 GW as facilities, chips, memory, and packaging capacity come online. It’s framed as a multi-generation collaboration—so as AMD advances its Instinct lineup, OpenAI’s deployments can refresh and scale.

Why It Matters

Compute bottlenecks: AI labs face chronic shortages; a second major supplier improves resiliency.

Cost dynamics: Broader supply can pressure pricing and improve long-term unit economics.

Innovation cadence: More predictable capacity unlocks ambitious model training schedules.

Timeline and Phases

Phase 1 (2H 2026): ~1 GW of MI450-based systems begins deployment.

Subsequent phases (2027+): Additional waves roll out as AMD ramps newer accelerators, HBM, and advanced packaging throughput.

Multi-year horizon: The 6-GW target is designed to be reached progressively, not all at once.

The Hardware: AMD Instinct Roadmap

MI450 launch wave: Targets training and high-throughput inference for large multimodal and agentic workloads.

Generational updates: Future Instinct parts are expected to drive higher performance per watt, larger memory footprints, and better interconnect bandwidth—key for trillion-parameter-class models.

Software stack: ROCm, kernel libraries, and framework integrations (PyTorch, JAX, Triton) must continue to mature to extract full performance.

Strategic Implications for OpenAI

Supply diversification: Reduces exposure to a single-vendor pipeline and packaging queue.

Capacity headroom: Supports next-gen foundation models, long-context reasoning, and agentic orchestration.

Economic leverage: A milestone-tied equity component can lower effective cost of compute if delivery targets are met.

Strategic Implications for AMD

Revenue and credibility: A hyperscale, multi-year anchor customer validates AMD’s accelerator stack at the top end of the market.

Ecosystem momentum: A marquee deployment accelerates ROCm adoption and vendor toolchain support.

Competitive posture: Strengthens AMD as the primary alternative in AI accelerators, intensifying competition on price, performance, and power efficiency.

Why “6 GW” Is a Big Number

Power-centric metric: “GW” reflects total data-center power capacity dedicated to AI clusters—not just chip counts.

Campus-scale builds: Several hyperscale campuses worth of tightly coupled GPU compute, networking, and storage are implied.

Operational readiness: Power delivery, cooling (air/liquid), and interconnect topology (e.g., ultra-high-bandwidth fabrics) must be architected for dense training clusters.

Risks, Constraints, and Unknowns

Manufacturing & packaging: Advanced packaging capacity and HBM supply remain industry-wide bottlenecks.

Software maturity: Peak performance hinges on optimized kernels, compilers, graph partitioning, and scheduler orchestration.

Integration timelines: Announced capacity must translate into on-time racks landing, cluster bring-up, and reliable fleet operations.

Opportunity cost: Delays could push workloads to other vendors or cloud providers if milestones slip.

How This Could Change the AI Chip Market

Price/performance discipline: A credible second source pressures pricing and shortens lead times.

Faster iteration cycles: With more predictable capacity, labs can run more frequent training and ablation cycles.

Ecosystem broadening: Cloud and on-prem vendors may standardize dual-stack offerings (Nvidia + AMD) to serve enterprise AI demand.

Use Cases the Deal Enables

Next-gen pretraining: Massive multimodal and agentic models with longer context windows and richer tool-use.

High-throughput inference: Serving complex assistants and agents with tight latency SLOs.

Enterprise AI at scale: Fine-tuning, RAG, and secure on-prem deployments on standardized AMD stacks.

FAQ

Is this OpenAI moving away from a single vendor?

Not a full move-away; it’s strategic diversification. OpenAI gains flexibility by adding a large-scale AMD path alongside existing suppliers.

When does the capacity arrive?

The first ~1 GW is planned for 2H 2026, with additional capacity rolling out over multiple years as manufacturing and data-center build-outs progress.

What’s the equity warrant about?

It’s a performance-tied incentive: if AMD meets certain delivery and execution milestones, OpenAI can exercise equity warrants—aligning both parties on on-time, at-scale delivery.

Bottom Line

The OpenAI–AMD partnership is a multi-year, multi-GW bet that fuses hardware, software, and incentives into one of the largest AI infrastructure programs to date. If execution matches ambition, it will ease compute scarcity, broaden the accelerator ecosystem, and intensify competition—benefiting model developers, enterprises, and ultimately, AI users at global scale.

OpenAI and AMD Partner in Monumental 6 GW AI Compute Deal